If you’re an investor or someone with a keen eye on property markets, this blog is for you. Dubai, the shining star of the UAE, has once again proven why it’s a global leader in real estate investments. Let’s check the hottest neighborhoods offering the highest returns on investment (ROI) and why they steal the spotlight.

A Record-Breaking Year in Dubai Real Estate

2024 has been another milestone year for Dubai’s real estate market. With 180,900 transactions valued at a jaw-dropping $142.1 billion, the city is breaking records and setting new standards. Favorable government policies, a robust economy, and an influx of global high-net-worth individuals fuel the market’s sustained growth. But what really makes Dubai a magnet for real estate investors? The answer lies in its lucrative ROI.

High-Yielding Affordable Neighborhoods in Dubai Real Estate

Let’s talk about Dubai’s property market: affordable apartments. Areas like Dubai Investments Park (DIP) and Discovery Gardens have been quietly swirling out impressive yields of 9% to 11%.

Why the high yields, you ask? These areas blend affordability with livability, attracting both tenants and investors looking for solid returns without breaking the bank. Whether it’s the strategic location, community vibe, or the burgeoning infrastructure, these neighborhoods are becoming the go-to spots for investors.

Mid-Tier Communities with Strong Returns

For those who prefer a middle ground, Dubai offers a buffet of mid-tier communities like Living Legends, Motor City, and Al Furjan, which clocks in ROI percentages above 8.7%. These areas strike a balance between affordability and lifestyle amenities, making them irresistible to families and professionals alike.

Let’s talk about the villas. Dubai Industrial City, International City, and DAMAC Hills 2 were seen with ROI figures of 6, and these communities offer a taste of suburban life with the perks of city convenience.

Luxury Real Estate: High-End Living, Higher Returns

Dubai’s luxury segment continues to dazzle. With neighborhoods like Al Sufouh, Green Community, and Al Barari reporting rental yields between 7% and 9%, the luxury market isn’t just about opulence; it’s a goldmine for investors.

For villas, areas like The Sustainable City, Al Barari, and Tilal Al Ghaf are leading and boasting ROIs exceeding 6%. These locales offer a blend of high-end living and sustainable practices, catering to a niche market that values both luxury and responsibility.

Investor Trends: Where the Smart Money Is Going

Data from Bayut reveals fascinating trends in investor preferences. Affordable areas like Dubai Silicon Oasis, Dubai Sports City, and Dubailand have seen a surge in interest, thanks to their budget-friendly options and potential for capital appreciation.

Mid-range properties are also enjoying their time in the sun. Neighborhoods such as Jumeirah Village Circle, Business Bay, and The Springs are gaining attraction, offering a perfect mix of price and location. Meanwhile, luxury investors flock to high-profile areas like Dubai Marina, Downtown Dubai, and Dubai Hills Estate.

Rising Property Prices: A Sign of Booming Demand

Dubai’s real estate isn’t just about impressive ROIs; it’s also about appreciating property values. Affordable apartment prices in key areas have surged by up to 26%, while villa prices have seen hikes of over 100% in certain spots like Dubailand.

Mid-range areas have witnessed price increases ranging from 7% to 40%, with Jumeirah Lake Towers leading the charge. Luxury properties haven’t been left behind, experiencing price climbs of 7% to 31%, with Dubai Hills Estate shining bright.

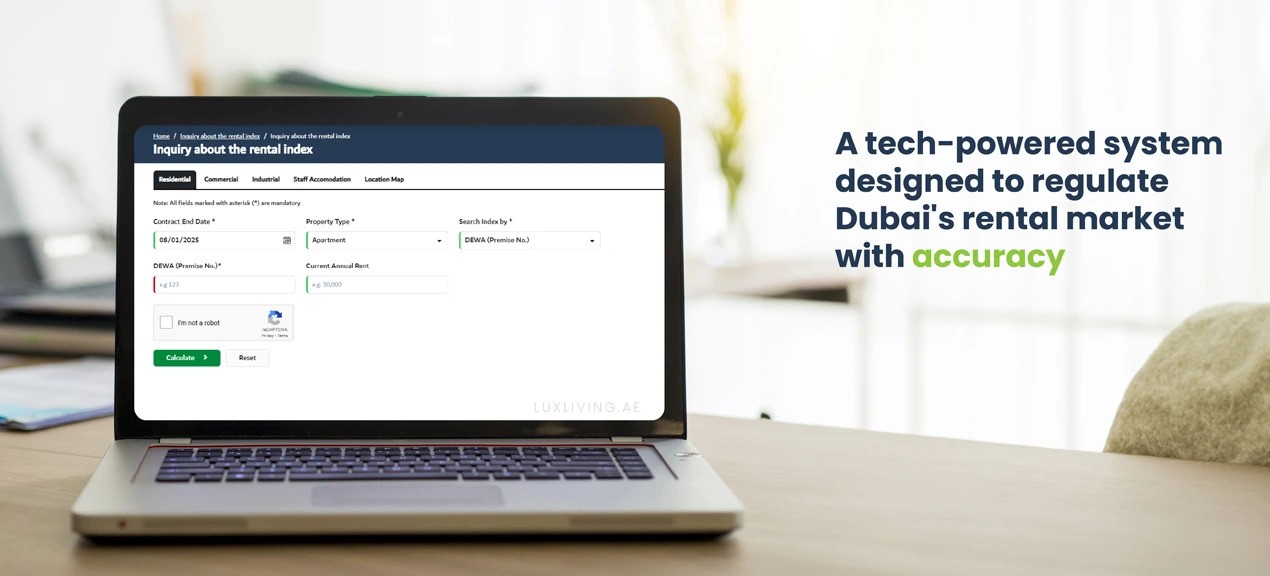

The Rental Market: Unprecedented Demand and Growth

The rental market in Dubai is another arena where the action never stops. Affordable apartment rentals have seen increases of up to 48%, with the biggest hikes in areas like Deira. Mid-tier rentals are following suit, with increases up to 41%, particularly in popular hubs like JLT.

Luxury apartment rents have also increased, growing between 5% and 25%. Villa rentals, especially in upscale areas like Jumeirah, have surged by up to 60%, reflecting the ever-growing demand for premium living spaces.

Conclusion: Dubai’s Real Estate – A Goldmine for Investors

Dubai’s real estate market is a treasure trove for investors. Whether you’re eyeing affordable apartments, mid-tier communities, or luxury villas, the city offers something for everyone. The combination of high ROI, appreciating property values, and a thriving rental market makes Dubai a top destination for real estate investments.

With over 4 million expats expected to call Dubai home by 2025, the demand for housing shows no signs of slowing down. So, whether you’re a seasoned investor or a first-time buyer, there’s no better time to dive into Dubai’s real estate market. After all, where else can you find such a perfect blend of opportunity, luxury, and innovation? Stay updated with us and visit our website regularly to access the latest insights, data, and trends shaping Dubai’s property market.